are funeral expenses tax deductible in australia

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. An estate tax deduction is generally allowed for funeral expenses including the cost of a burial lot and amounts that are expended for the care of the lot.

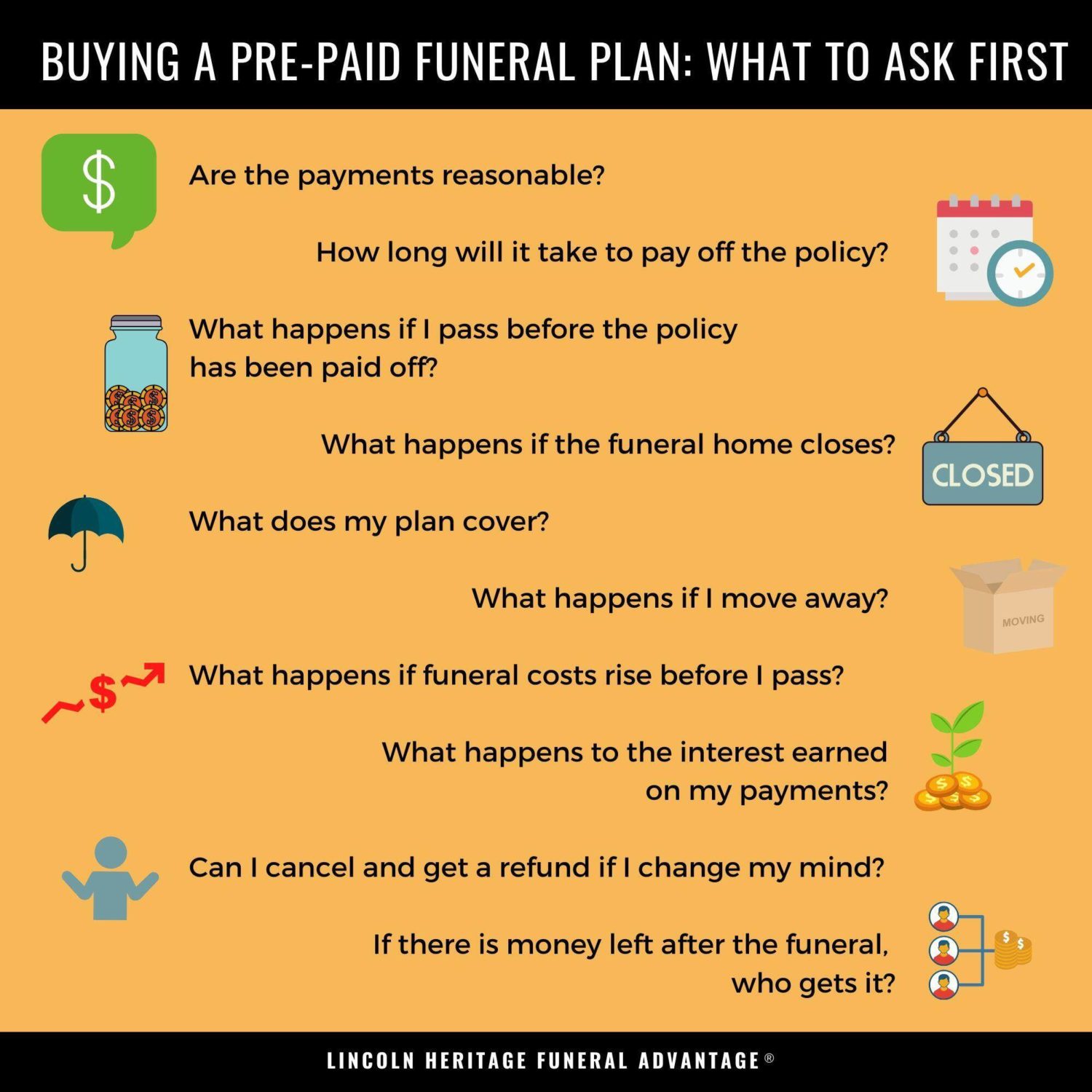

10 Tax Deductible Funeral Service Costs

In short these expenses are not eligible to be claimed on a 1040 tax.

. Feb 21 2020 Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. To claim a deduction for a work-related expense you must meet the 3 golden rules. What funeral expenses are tax deductible.

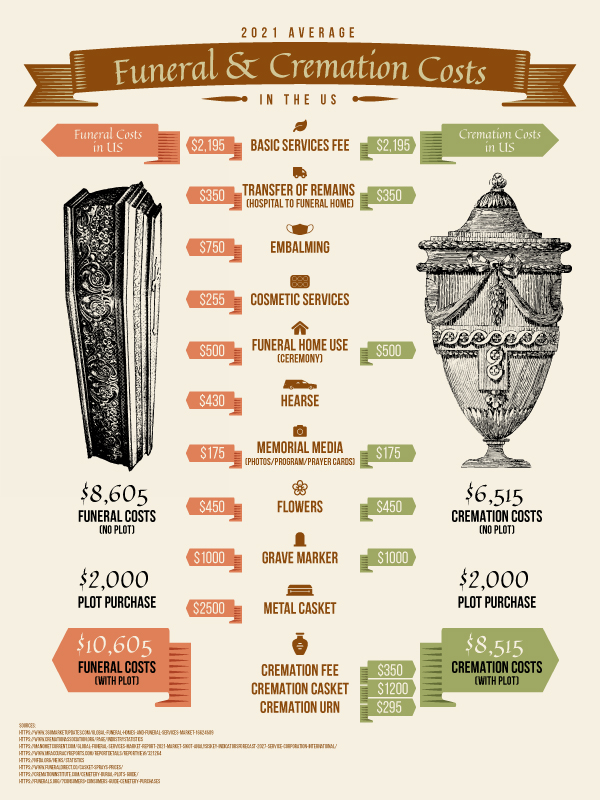

In order for funeral expenses to be deductible you would need to have paid for the. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. You must have spent the money yourself and werent reimbursed. For example if you receive financial.

Mar 20 2020 You may. The expenses must directly relate to. While the IRS allows deductions for medical expenses funeral costs are not included.

This doesnt include funeral expenses. While the IRS allows deductions for medical expenses funeral costs are not included. What Funeral Expenses Are Tax Deductible.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Confirming tax obligations are complete. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

If you are a beneficiary of a deceased estate. Check that all tax obligations are complete before the final distribution of the deceased estate. Funeral Expenses Tax Deductible Australia An estate tax deduction is generally allowed for funeral expenses including the cost of a burial lot and amounts that are expended for the care.

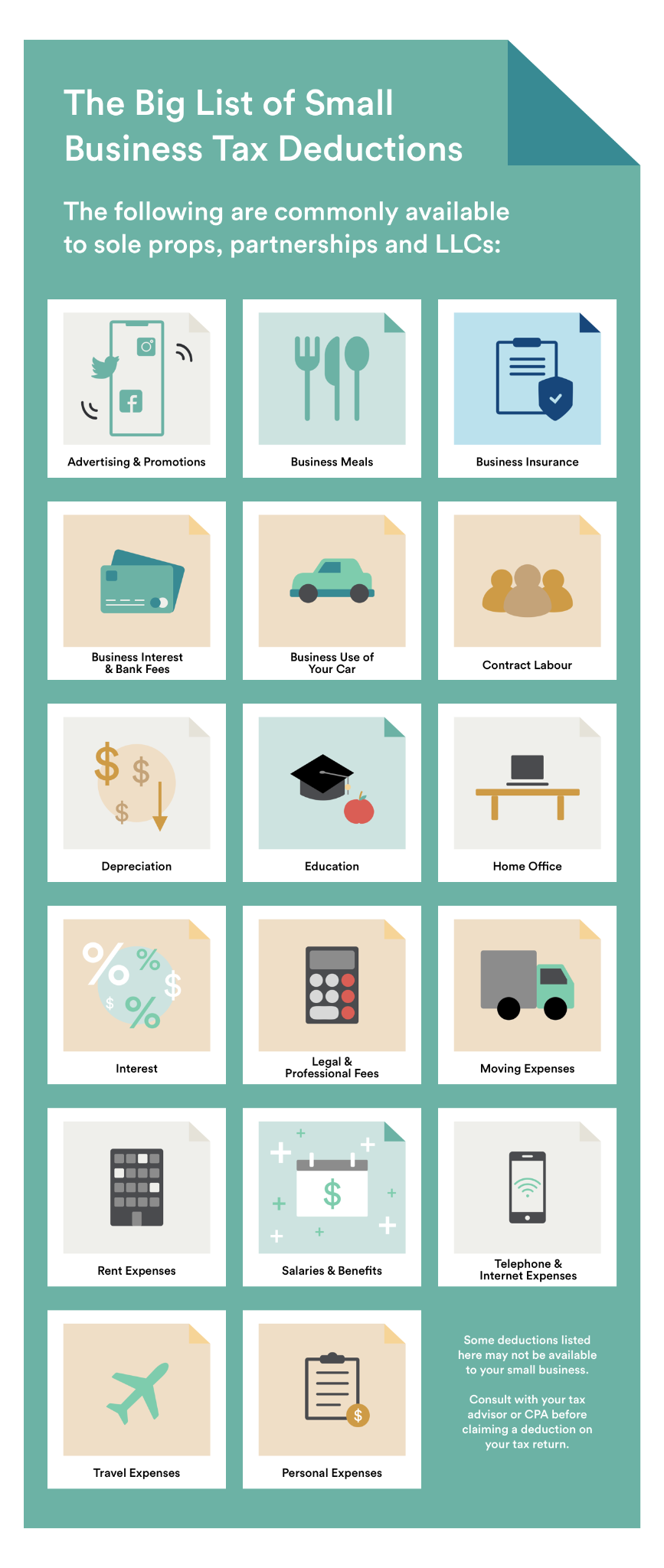

Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. As we mentioned funeral expenses arent tax-deductible for most individuals. Individual taxpayers cannot deduct funeral expenses on their tax return.

Question Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. This means that you cannot deduct the cost of a funeral from your.

The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172. Any deductible expenses incurred after the date of death. Funeral expenses are included in box 81 of the IHT400.

However there are a few exceptions to this rule. Generally funeral expenses are tax deductible if theyre paid out of your own personal funds. What funeral expenses are deductible.

However end-of-life expenses are tax-deductible if they exceed 75 of the persons adjusted. Individual taxpayers cannot deduct funeral expenses on their tax return. Taxpayers are asked to provide a.

Funeral Cremation Costs In 2022 A Complete Guide

Which Statement Is Incorrect About Funeral Expenses Allowed Taxation Estate Tax Course Hero

Ecommerce Business Insurance Options For Retailers 2022 Shopify Nigeria

The Business Travel Tax Deduction What It Is And How To Take Advantage Of It Traveldailynews International

How Much Should You Donate To Charity District Capital

Funeral Expenses Tax Deductible Ato Best Reviews

Medical Expenses Tax Offset Online Tax Australia

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Inheriting From The United States While Living Abroad

Inheriting From The United States While Living Abroad

Are Funeral And Cremation Expenses Tax Deductible National Cremation

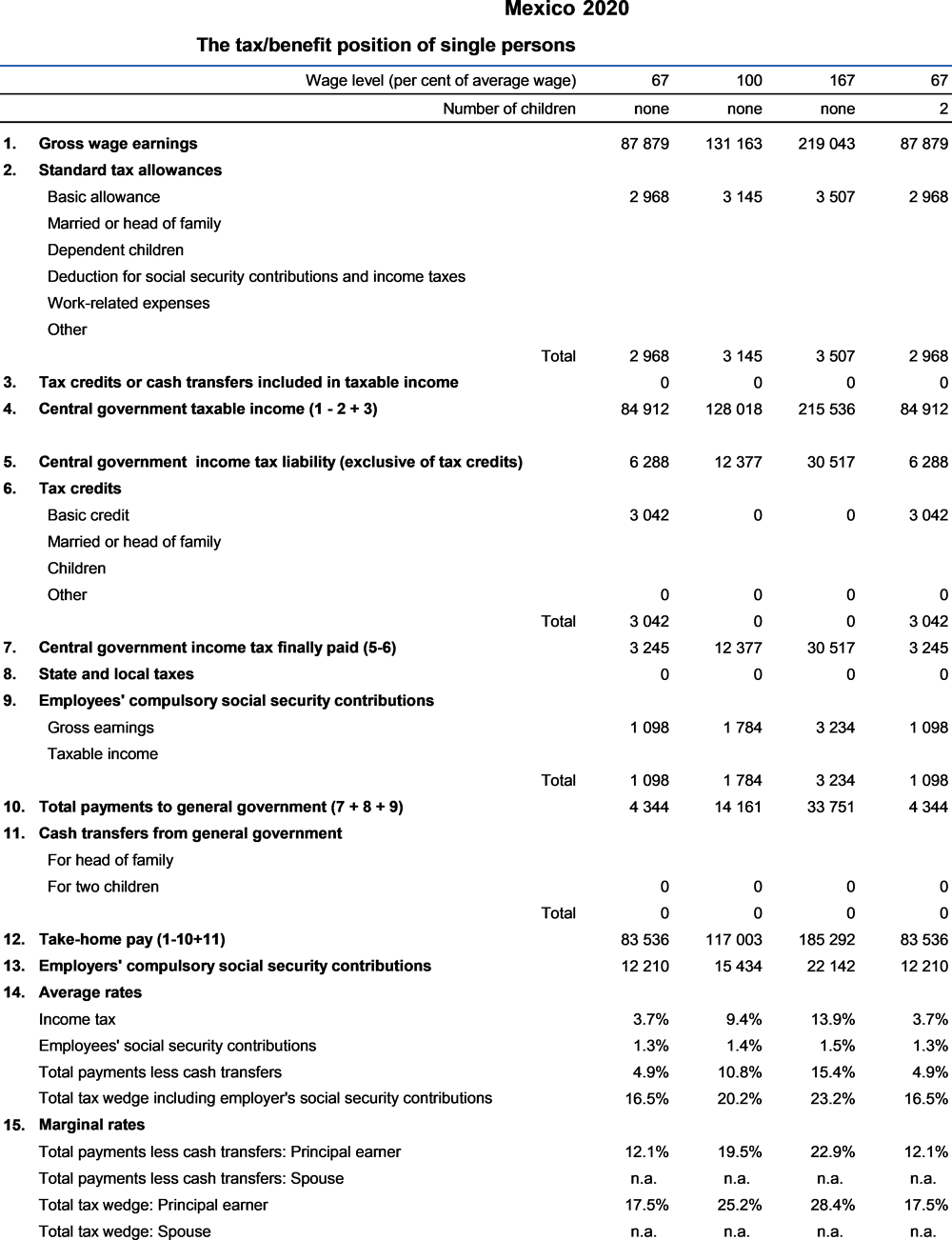

Mexico Taxing Wages 2021 Oecd Ilibrary

Is 65 000 Aud Per Annum Excluding Super Without Tax Deductions A Good Pay For An E2 Band In Hcl Australia If Not What Can Be The Salary Range For A Senior Software

Nj Estate And Inheritance Tax 2017

New Laws You Should Know About This Tax Season Kabb

Australian Taxation Office Ever Wondered What Expenses You Can Claim As A Work Related Deduction At Tax Time Mobile Phone Hand Sanitiser Seminar Or Work Related Course Sunglasses

10 Tax Deductible Funeral Service Costs

Comparing Life Insurance Policies In The U S Uk And Australia